Multiple Choice

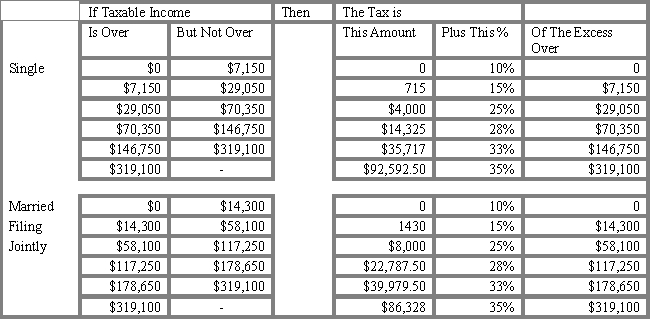

USE THE TAX TABLE PROVIDED BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 2.1. What is the tax liability for a married couple filing jointly with taxable income of $125,000?

A) $23,800

B) $18,427

C) $24,958

D) $16,867

E) $19,650

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q60: Which of the following strategies seeks to

Q61: An example of a unique need in

Q62: The policy statement may include a _

Q63: What would the after-tax yield be on

Q64: For an investor with a time horizon

Q66: For an investor with a time horizon

Q67: Which of the following is NOT considered

Q68: Most art and antiques are _, and

Q69: An individual in the 36 percent tax

Q70: Term life insurance provides both a death