Multiple Choice

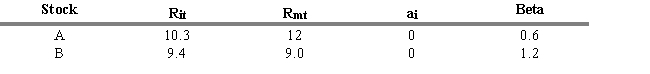

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

-Refer to Exhibit 5.4. What is the abnormal rate of return for Stock B when you consider its systematic risk measure (beta) ?

A) 0.1 percent

B) -1.4 percent

C) 0.5 percent

D) 1.5 percent

E) 2.0 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q129: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q130: A technical analyst would consider a put

Q131: According to prospect theory,<br>A) investors have a

Q132: When the 50-day MA line crosses the

Q133: The following are classified as contrary trading

Q135: Which of the following is NOT considered

Q136: A high put/call ratio indicates a pervasive

Q137: According to Wood (2010), which three tributaries

Q138: The Dow Theory contends that stock price

Q139: A chart used to show only significant