Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

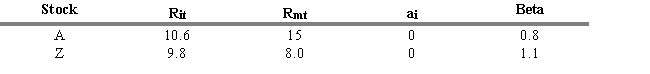

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

-Refer to Exhibit 5.5. What is the abnormal rate of return for Stock A when you consider its systematic risk measure (beta) ?

A) 1.40 percent

B) -1.40 percent

C) 2.80 percent

D) -2.80 percent

E) 0 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q63: The T-Bill-Eurodollar yield spread widens during periods

Q64: When the 50-day moving average crosses the

Q65: The use of trading rules requires a

Q66: Researchers have found a positive relationship between

Q67: The weak form of the efficient market

Q69: Even when fees and costs are considered,

Q70: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q71: Contrary trading rules assert that investors tend

Q72: Investigators have tested the strong form EMH

Q73: The confidence index increases as the yield