Multiple Choice

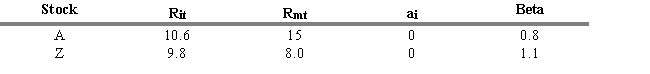

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

-Refer to Exhibit 5.5. What is the abnormal rate of return for Stock Z when you consider its systematic risk measure (beta) ?

A) 0.1 percent

B) 1.0 percent

C) 0.5 percent

D) -1.0 percent

E) -2.0 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q106: An efficient market requires a large number

Q107: A resistance level is the price range

Q108: A portfolio manager without superior analytical skills

Q109: A type of charting that normally disregards

Q110: If the efficient market hypothesis is true,

Q112: Results of studies concerning corporate insider trading

Q113: A technical analyst would consider the following

Q114: Some studies have attempted to determine whether

Q115: The relative strength ratio for a stock

Q116: A narrowing of the T-bill-Eurodollar is a