Multiple Choice

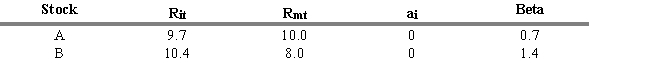

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

-Refer to Exhibit 5.6. What is the abnormal rate of return for Stock A when you consider its systematic risk measure (beta) ?

A) -2.3 percent

B) -0.3 percent

C) 0.3 percent

D) 2.3 percent

E) 3.0 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q87: The breadth of the market measures the

Q88: If the 50-day moving average line crosses

Q89: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q90: An investor who can do a superior

Q91: One of the potential disadvantages of technical

Q93: The random walk hypothesis contends that stock

Q94: If 10 percent of the stocks are

Q95: According to the weak-form efficient market hypothesis,

Q96: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q97: Technical analysts believe that security prices do