Multiple Choice

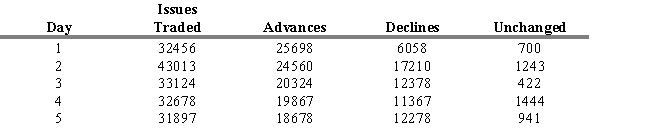

Calculate the net advance-decline for day 5 using the trade data in the table below.

A) -5,459

B) 941

C) 5,459

D) 6,400

E) 7,853

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Analysts following what the smart, sophisticated investor

Q3: According to contrary opinion technicians, the ratio

Q4: Fusion investing refers to the combination of<br>A)

Q5: A rise in the Confidence Index published

Q6: Indicators that tell what smart investors are

Q7: Two major classes of technicians include the

Q8: There is empirical evidence that low P/E

Q9: A "runs test" on successive stock price

Q10: Fama and French examined the relationship between

Q11: A contrary opinion technician would buy stock