USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

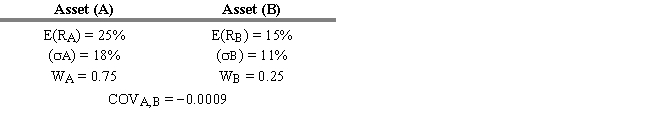

I), Covariance (COVi,j), and Asset Weight (Wi) Are as Shown

Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.2. What is the expected return of a portfolio of two risky assets if the expected return E(Ri) , standard deviation ( i) , covariance (COVi,j) , and asset weight (Wi) are as shown above?

A) 18.64%

B) 20.0%

C) 22.5%

D) 13.65%

E) 11%

Correct Answer:

Verified

Correct Answer:

Verified

Q54: Between 1994 and 2004, the standard deviation

Q55: When identifying undervalued and overvalued assets, which

Q56: All of the following are assumptions of

Q57: As the correlation coefficient between two assets

Q58: Which of the following is NOT a

Q60: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q61: Studies have shown that a well-diversified investor

Q62: Combining assets that are NOT perfectly correlated

Q63: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q64: USE THE INFORMATION BELOW FOR THE