Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

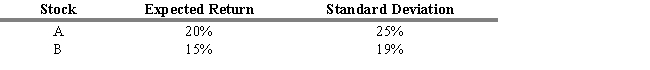

Stocks A and B have a correlation coefficient of -0.8. The stocks' expected returns and standard deviations are in the table below. A portfolio consisting of 40% of stock A and 60% of stock B is constructed.

-Refer to Exhibit 6.14. What is the standard deviation of the stock A and B portfolio?

A) 0.0%

B) 0.5%

C) 4.1%

D) 6.9%

E) 20.3%

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Theoretically, the correlation coefficient between a completely

Q10: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q11: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q12: Prior to the work of Markowitz in

Q13: The rate of return on a risk-free

Q15: You are given a two-asset portfolio with

Q16: Which of the following is NOT an

Q17: A risk-free asset is one in which

Q18: Markowitz assumed that, given an expected return,

Q19: The combination of two assets that are