Multiple Choice

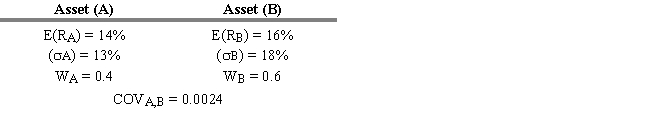

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.15. What is the standard deviation of this portfolio?

A) 10.0%

B) 12.5%

C) 14.4%

D) 15.5%

E) 16.0%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: Between 1990 and 2000, the standard deviation

Q4: One of the assumptions of capital market

Q5: An individual investor's utility curves specify the

Q6: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q7: 16.99%What is the expected return of the

Q9: Theoretically, the correlation coefficient between a completely

Q10: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q11: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q12: Prior to the work of Markowitz in

Q13: The rate of return on a risk-free