Multiple Choice

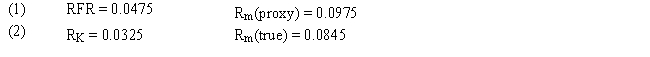

Assume that as a portfolio manager the beta of your portfolio is 0.85 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

A) 1.33% higher

B) 2.35% lower

C) 8% lower

D) 1.33% lower

E) 2.35% higher

Correct Answer:

Verified

Correct Answer:

Verified

Q91: The betas for the market portfolio and

Q92: A portfolio manager uses two different proxies

Q93: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q94: If the market portfolio is mean-variance efficient,

Q95: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q97: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q98: An investor wishes to construct a portfolio

Q99: Consider a risky asset that has a

Q100: Securities with returns that lie below the

Q101: If the assumption that there are no