Multiple Choice

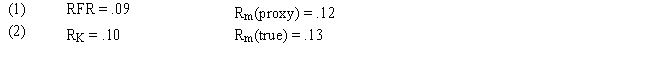

Assume that as a portfolio manager the beta of your portfolio is 1.2 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

A) 2 percent lower

B) 1 percent lower

C) 5 percent lower

D) 1 percent higher

E) 2 percent higher

Correct Answer:

Verified

Correct Answer:

Verified

Q69: CAPM states that only the overall market

Q70: In a macroeconomic-based risk factor model, the

Q71: Findings by Basu that stocks with high

Q72: USE THE INFORMATION BELOW FOR THE

Q73: An investor constructs a portfolio with a

Q75: Studies have shown the beta is more

Q76: Calculate the expected return for B Services

Q77: Unlike the capital asset pricing model, the

Q78: Recently your broker has advised you that

Q79: The capital asset pricing model (CAPM) extends