Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

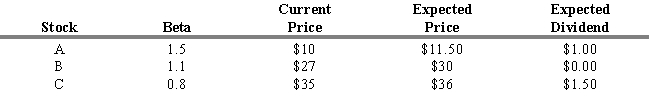

You expect the risk-free rate (RFR) to be 4 percent and the market return to be 10 percent. You also have the following information about three stocks.

-Refer to Exhibit 7.7. What are the required rates of return for the three stocks (in the order A, B, C) ?

A) 13.0 percent, 10.6 percent, 8.8 percent

B) 15.0 percent, 11.1 percent, 2.9 percent

C) 18.7 percent, 11.1 percent, 8.8 percent

D) 21.7 percent, 10.0 percent, 6.9 percent

E) 25.0 percent, 11.1 percent, 7.1 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q102: The usefulness of CAPM theory is limited

Q103: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q104: The _ the number of stocks in

Q105: Dhrymes, Friend, and Gultekin, in their study

Q106: If an individual owns only one security

Q108: Under the following conditions, what are the

Q109: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q110: Beta is a measure of<br>A) company specific

Q111: The error caused by NOT using the

Q112: USE THE INFORMATION BELOW FOR THE FOLLOWING