Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

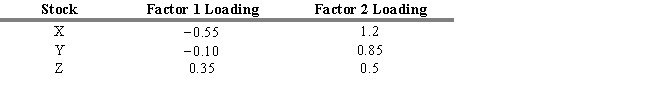

Consider the three stocks, stock X, stock Y, and stock Z, that have the following factor loadings (or factor betas) .

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

-Refer to Exhibit 7.9. The expected returns for stock X, stock Y, and stock Z are

A) 3 percent, 8 percent, 10 percent

B) 7.1 percent, 10.5 percent, 8.8 percent

C) 7.1 percent, 8.8 percent, 10.5 percent

D) 10 percent, 5.5 percent, 14 percent

E) 14 percent, 5.5 percent, 12 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q142: Because the market portfolio is reasonable in

Q143: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q144: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q145: Assume that you are embarking on a

Q146: The capital market line (CML) uses _

Q147: Recently you have received a tip that

Q148: In one of their empirical tests of

Q149: The only way to estimate a beta

Q151: Fama and French suggest a three-factor model

Q152: The Capital Market Line (CML) refers only