Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

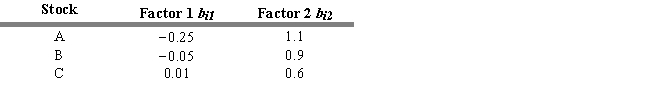

Stocks A, B, and C have two risk factors with the following beta coefficients. The zero-beta return ( 0) = .025 and the risk premiums for the two factors are ( 1) = .12 and ( 0) = .10.

-Refer to Exhibit 7.10. Calculate the expected returns for stocks A, B, and C. A B C

A) 0.082 0.091 0.033

B) 0.105 0.109 0.032

C) 0.132 0.128 0.033

D) 0.165 0.121 0.032

E) 0.850 0.850 0.610

Correct Answer:

Verified

Correct Answer:

Verified

Q8: The APT assumes that capital markets are

Q9: Using the S&P index as the proxy

Q10: Which of the following is not a

Q11: The excess return form of the

Q12: Consider an asset that has a beta

Q14: Arbitrage Pricing Theory (APT) specifies the exact

Q15: USE THE INFORMATION BELOW FOR THE

Q16: Calculate the expected return for E Services,

Q17: Under the following conditions, what are the

Q18: The expected return for a stock, calculated