Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

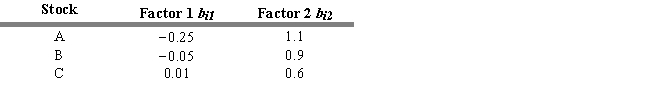

Stocks A, B, and C have two risk factors with the following beta coefficients. The zero-beta return ( 0) = .025 and the risk premiums for the two factors are ( 1) = .12 and ( 0) = .10.

-Refer to Exhibit 7.10. Assume that stocks A, B, and C never pay dividends and stocks A, B, and C are currently trading at $10, $20, and $30, respectively. What is the expected price next year for each stock? A B C

A) $10.82 $21.82 $30.99

B) $11.05 $22.18 $30.96

C) $11.32 $22.56 $30.99

D) $11.65 $22.42 $30.96

E) $18.50 $37.00 $48.30

Correct Answer:

Verified

Correct Answer:

Verified

Q80: In a multifactor model, confidence risk represents<br>A)

Q81: An investor wishes to construct a portfolio

Q82: A major advantage of the Arbitrage Pricing

Q83: Under the following conditions, what are the

Q84: Beta is a measure of unsystematic risk.

Q86: In the APT model the idea of

Q87: The APT assumes that security returns are

Q88: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q89: A friend has some reliable information that

Q90: Two approaches to defining factors for multifactor