Multiple Choice

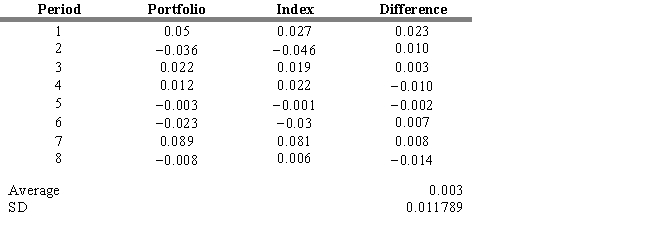

The table below provides returns on a portfolio along with returns for the corresponding benchmark index for the past eight quarters. The table also provides the difference between portfolio returns and the benchmark index, the average of these differences over the past eight quarters, and the standard deviation of these differences.  The annualized tracking error for this period is

The annualized tracking error for this period is

A) 2.36 percent.

B) 4.08 percent

C) 2.89 percent.

D) 3.33 percent.

E) 1.18 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q49: The strategy that frequently adjusts the asset

Q50: An investor focusing on a growth strategy

Q51: In _ asset allocation, the investor's risk

Q52: Which of the following statements about investment

Q53: Growth stocks would have the following characteristics:<br>A)

Q55: The goal of a passive portfolio is

Q56: Value stocks would have the following characteristics:<br>A)

Q57: Which of the following is NOT considered

Q58: Following an earnings momentum strategy, an investor

Q59: _ is a strategy used because the