Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

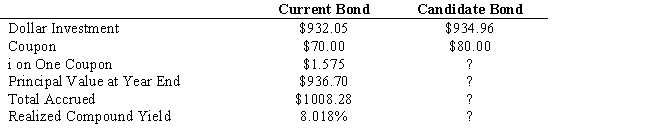

The following information is given concerning a pure yield pick-up swap: You currently hold a 10-year, 7 percent coupon bond priced to yield 8 percent. As a swap candidate, you are considering a 10-year, 8 percent coupon bond priced to yield 9 percent. Assume a reinvestment at 9 percent, semiannual compounding, and a one-year workout period.

-Refer to Exhibit 13.4. The realized compound yield on the candidate bond is

A) 7.0%.

B) 11.0%.

C) 10.0%.

D) 9.0%.

E) 12.0%.

Correct Answer:

Verified

Correct Answer:

Verified

Q105: With a matched funding technique, portfolio managers

Q106: Altman-Nammacher (1987) created a modified Z-score model

Q107: Interest rate anticipation is the most conservative

Q108: All of the following are one of

Q109: Calculate the modified duration for a 10-year,

Q111: Option adjusted duration can be calculated as<br>A)

Q112: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q113: In core-plus bond management,<br>A) 75 percent of

Q114: If you expected interest rates to rise,

Q115: USE THE INFORMATION BELOW FOR THE FOLLOWING