Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

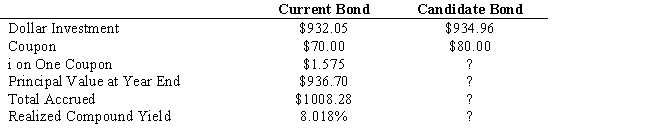

The following information is given concerning a pure yield pick-up swap: You currently hold a 10-year, 7 percent coupon bond priced to yield 8 percent. As a swap candidate, you are considering a 10-year, 8 percent coupon bond priced to yield 9 percent. Assume a reinvestment at 9 percent, semiannual compounding, and a one-year workout period.

-Refer to Exhibit 13.4. The value of the swap is ____ basis points in one year.

A) 32.3

B) 48.7

C) 75.8

D) 98.2

E) 104.3

Correct Answer:

Verified

Correct Answer:

Verified

Q28: The position of a bondholder that is

Q29: In a ladder strategy,<br>A) one-half of funds

Q30: Because you expect market interest rates to

Q31: Consider a bond with a duration of

Q32: Assume that you purchase a five-year, $1,000

Q34: There is an inverse relationship between duration

Q35: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q36: A pure yield pickup swap involves a

Q37: Bond price volatility varies directly with the

Q38: Which of the following would NOT normally