Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

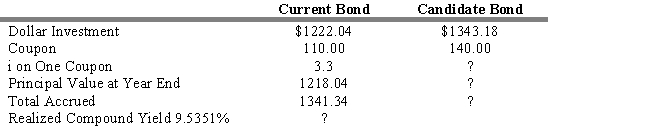

The following information is given concerning a pure yield pick-up swap: You currently hold a 20-year, Aa 2 percent coupon bond priced to yield 9.5 percent. As a swap candidate, you are considering a 20-year, Aa 14 percent coupon bond priced to yield 10.00. Assume a reinvestment rate of 11 percent, semiannual compounding, and a one-year workout period.

-Refer to Exhibit 13.8. The interest on one coupon for the candidate bond is

A) $70.00.

B) $3.58.

C) $3.85.

D) $8.35.

E) $5.38.

Correct Answer:

Verified

Correct Answer:

Verified

Q58: Investment style for a bond portfolio is

Q59: Modified duration is determined by making small

Q60: When applying active management techniques to a

Q61: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q62: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q64: Studies by Reilly and Wright (1994, 2001)

Q65: Calculate the duration of a 6 percent,

Q66: For a given change in yield bond

Q67: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q68: Credit analysis and core-plus management are examples