Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

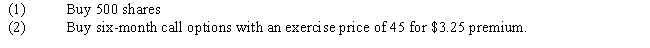

Rick Thompson is considering the following alternatives for investing in Davis Industries, which is now selling for $44 per share:

-Refer to Exhibit 14.2. Assuming no commissions or taxes, what is the annualized percentage gain if the stock is at $30 in four months and the stock was purchased?

A) 9.54 percent loss

B) 95.45 percent loss

C) 0.9545 percent gain

D) 95.45 percent gain

E) 9.54 percent gain

Correct Answer:

Verified

Correct Answer:

Verified

Q79: Futures contracts are similar to forward contracts

Q80: A futures contract is an agreement between

Q81: Consider a stock that is currently trading

Q82: The minimum amount that must be maintained

Q83: A stock currently sells for $75 per

Q85: In the valuation of an option contract,

Q86: Which of the following statements is a

Q87: A stock currently trades for $115. January

Q88: A hedge strategy known as a collar

Q89: Futures contracts are slower to absorb new