Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

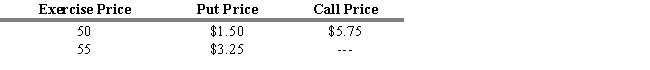

The current stock price of ABC Corporation is $53.50. ABC Corporation has the following put and call option prices that expire six months from today. The risk-free rate of return is 5 percent, and the expected return on the market is 11 percent.

-Refer to Exhibit 14.6. How could an investor create arbitrage profits?

A) sell the stock short, write a put, buy a call, and invest the proceeds at the risk-free rate

B) buy the stock, write a put, buy a call, and invest the proceeds at the risk-free rate

C) sell the stock short, buy a put, write a call, and invest the proceeds at the risk-free rate

D) buy the stock, write a put, buy a call, and borrow the strike price at the risk-free rate

E) sell the stock short, write a put, buy a call, and borrow the strike price at the risk-free rate.

Correct Answer:

Verified

Correct Answer:

Verified

Q90: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q91: A one-year call option has a strike

Q92: You own a call option and put

Q93: Assume that you purchased shares of a

Q94: An advantage of a forward contract over

Q96: The derivative based strategy known as portfolio

Q97: A one-year call option has a strike

Q98: A put option is in the money

Q99: You own a stock that has risen

Q100: USE THE INFORMATION BELOW FOR THE FOLLOWING