Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

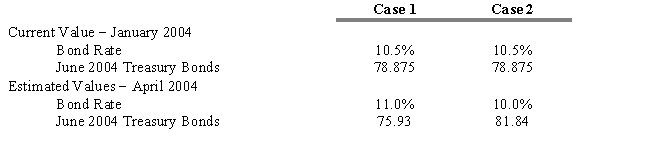

In late January 2004, The Union Cosmos Company is considering the sale of $100 million in 10-year bonds that will probably be rated AAA like the firm's other bond issues. The firm is anxious to proceed at today's rate of 10.5 percent. As treasurer, you know that it will take until sometime in April to get the issue registered and sold. Therefore, you suggest that the firm hedge the pending issue using Treasury bond futures contracts each representing $100,000.

-Refer to Exhibit 15.1. Explain how you would go about hedging the bond issue?

A) sell 1,000 contracts

B) buy 1,000 contracts

C) sell 100 contracts

D) sell 10,000 contracts

E) buy 10,000 contracts

Correct Answer:

Verified

Correct Answer:

Verified

Q111: The process by which invest on margin

Q112: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q113: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q114: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q115: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q117: Forward contracts are individually designed agreements and

Q118: In your portfolio you have $1 million

Q119: Financial futures include all of the following

Q120: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q121: USE THE INFORMATION BELOW FOR THE FOLLOWING