Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

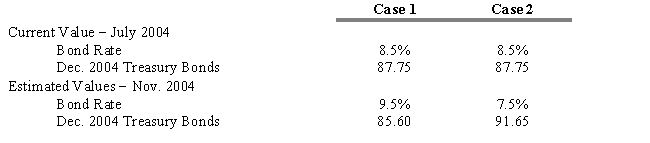

Assume you are the Treasurer for the Johnson Pharmaceutical Company and in late July 2004, the company is considering the sale of $500 million in 20-year bonds that will most likely be rated the same as the firm's other debt issues. The firm would like to proceed at the current rate of 8.5%, but you know that it will probably take until November to bring the issue to market. Therefore, you suggest that the firm hedge the pending issue using Treasury bond futures contracts, which each represent $100,000.

-Refer to Exhibit 15.2. How you would go about hedging the bond issue?

A) buy 5,000 contracts

B) buy 50,000 contracts

C) sell 5,000,000 contracts

D) sell 5,000 contracts

E) sell 500 contracts

Correct Answer:

Verified

Correct Answer:

Verified

Q89: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q90: In a forward rate agreement (FRA), two

Q91: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q92: The basis is the spot price minus

Q93: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q95: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q96: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q97: If you were bearish on the near-term

Q98: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q99: In an interest rate swap, the fixed