Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

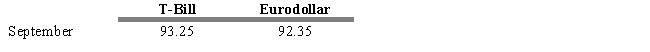

Assume that you observe the following prices in the T-Bill and Eurodollar futures markets

-Refer to Exhibit 15.5. If you expected the TED spread to widen over the next month, then an appropriate strategy would be to

A) go long T-Bill futures and long Eurodollar futures.

B) go short T-Bill futures and short Eurodollar futures.

C) go long T-Bill futures and short Eurodollar futures.

D) go short T-Bill futures and long Eurodollar futures.

E) None of these are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Assume that you manage an equity portfolio.

Q6: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q7: A bond portfolio manager expects a cash

Q8: As a contract approaches maturity, the spot

Q9: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q11: The cost of carry includes all of

Q12: The basis (B<sub>t,T</sub>) at time t between

Q13: Margin accounts are adjusted, or marked to

Q14: Which of the following is NOT true

Q15: USE THE INFORMATION BELOW FOR THE FOLLOWING