Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

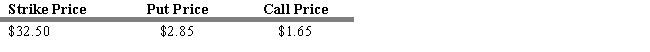

Consider the following information on put and call options for Citigroup

-Refer to Exhibit 16.4. Calculate the net value of a protective put position at a stock price at expiration of $20 and a stock price at expiration of $45.

A) $6.35, $18.85

B) $29.65, $42.15

C) $21.65, $34.15

D) $8, $8

E) -$8, -$8

Correct Answer:

Verified

Correct Answer:

Verified

Q5: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q6: A portfolio containing a share of stock

Q7: The Chicago Board Options Exchange has the

Q8: The binomial option pricing model approximates the

Q9: Index options can only be settled in

Q11: A strip is a call option on

Q12: The underlying stock price and the value

Q13: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q14: The owner of a call option on

Q15: USE THE INFORMATION BELOW FOR THE FOLLOWING