Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

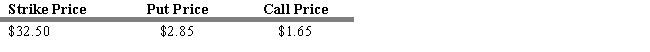

Consider the following information on put and call options for Citigroup

-Refer to Exhibit 16.4. A long straddle is an appropriate strategy if

A) an investor wishes to generate additional income.

B) an investor wished to insure against a decline in share values.

C) an investor expected share prices to be volatile.

D) an investor expected share prices to remain in a trading range.

E) an investor expected share prices to be volatile but was inclined to be bullish.

Correct Answer:

Verified

Correct Answer:

Verified

Q105: All of the following are normal characteristics

Q106: A price spread (or vertical spread) involves

Q107: In the Black-Scholes option pricing model, an

Q108: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q109: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q111: The creation of the CBOE led to

Q112: Credit risk in the options market is

Q113: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q114: In the Black-Scholes model N(d<sub>1</sub>) represents the<br>A)

Q115: Assume that you have just sold a