Multiple Choice

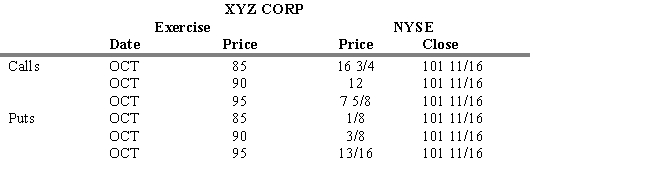

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 16.8. If you establish a long straddle using the options with a 95 exercise price, what is your dollar gain or loss if at expiration XYZ is still trading at 101 11/16?

A) $668.75 gain

B) $668.75 loss

C) $94.56 gain

D) $94.56 loss

E) $81.25 loss

Correct Answer:

Verified

Correct Answer:

Verified

Q37: A vertical spread involves buying and selling

Q38: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q39: A foreign currency option contract traded on

Q40: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q41: The issuance of convertibles will ultimately lead

Q43: The calculation of a weighted average of

Q44: If the hedge ratio is 0.50, this

Q45: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q46: The conversion price parity for a convertible

Q47: In the Black-Scholes option pricing model,