Multiple Choice

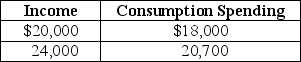

Table 18-3

Table 18-3 contains data on household spending at different income levels.Suppose that a 3 percent tax is levied on all consumption spending.

Table 18-3 contains data on household spending at different income levels.Suppose that a 3 percent tax is levied on all consumption spending.

-Refer to Table 18-3.Calculate the percent of income paid in taxes by a family with $20,000 income and by a family with $24,000 income.

A) The family with a $20,000 income pays 2.7 percent of its income in consumption taxes and the family with a $24,000 income pays 2.6 percent of its income in consumption taxes.

B) Each family pays 3 percent of their respective incomes in consumption taxes.

C) The family with a $20,000 income pays 15 percent of its income in consumption taxes and the family with a $24,000 income pays 33.3 percent of its income in consumption taxes.

D) There is insufficient information to make these calculations.

Correct Answer:

Verified

Correct Answer:

Verified

Q39: When members of Congress vote to pass

Q84: The burden of a tax on soft

Q85: Which of the following is an example

Q92: Which of the following explains one difference

Q96: The proposition that the outcome of a

Q112: Which of the following statements concerning the

Q120: According to the benefits-received principle of taxation<br>A)individuals

Q138: Congressman Gallstone seeks support from his colleagues

Q157: Which of the following is the largest

Q175: In reference to the federal income tax