Multiple Choice

Table 18-6

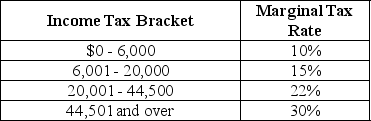

Table 18-6 shows the income tax brackets and tax rates for single taxpayers in Monrovia.

Table 18-6 shows the income tax brackets and tax rates for single taxpayers in Monrovia.

-Refer to Table 18-6.Sylvia is a single taxpayer with an income of $70,000.What is her marginal tax rate and what is her average tax rate?

A) marginal tax rate = 30%; average tax rate = 30%

B) marginal tax rate = 8%; average tax rate = 19.3%

C) marginal tax rate = 30%; average tax rate = 22.5%

D) marginal tax rate = 20%; average tax rate = 30%

Correct Answer:

Verified

Correct Answer:

Verified

Q71: Which of the following statements refers to

Q90: From 1970 to 2006, the poverty rate

Q107: According to the benefits-received principle, those who

Q115: Logrolling refers to attempts by individuals to

Q129: In 2010,which type of tax raised the

Q131: Table 18-3<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4186/.jpg" alt="Table 18-3

Q176: Which of the following is an example

Q182: Studies by the U.S.Census Bureau have shown

Q197: One result of the public choice model

Q250: Economists James Buchanan and Gordon Tullock are