Essay

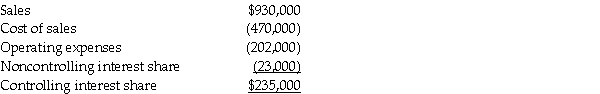

Pastern Industries has an 80% ownership stake in Sascon Incorporated.At the time of purchase, the book value of Sascon's assets and liabilities were equal to the fair value.The cost of the 80% investment was equal to 80% of the book value of Sascon's net assets.At the end of 2011, they issued the following consolidated income statement:

Shortly after the statements were issued, Pastern discovered that the 2011 intercompany sales transactions had not been properly eliminated in consolidation.In fact, Pastern had sold inventory that cost $80,000 to Sascon for $90,000, and Sascon had sold inventory that cost $50,000 to Pastern for $65,000.Half of the products from both transactions still remained in inventory at December 31, 2011.

Shortly after the statements were issued, Pastern discovered that the 2011 intercompany sales transactions had not been properly eliminated in consolidation.In fact, Pastern had sold inventory that cost $80,000 to Sascon for $90,000, and Sascon had sold inventory that cost $50,000 to Pastern for $65,000.Half of the products from both transactions still remained in inventory at December 31, 2011.

Required: Prepare a corrected income statement for Pastern and Subsidiary for 2011.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Salli Corporation regularly purchases merchandise from their

Q9: Use the following information to answer the

Q20: Use the following information to answer the

Q25: Use the following information to answer the

Q32: Perry Instruments International purchased 75% of the

Q34: Presented below are several figures reported for

Q35: Plover Corporation acquired 80% of Sink Inc.equity

Q36: Papal Corporation acquired an 80% interest in

Q37: On January 1,2011,Palling Corporation purchased 70% of

Q39: Use the following information to answer the