Essay

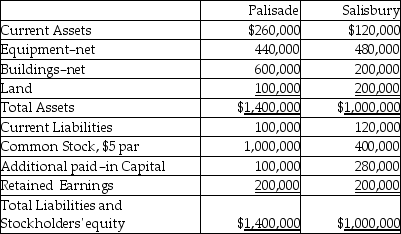

The balance sheets of Palisade Company and Salisbury Corporation were as follows on December 31, 2010:

On January 1, 2011 Palisade issued 30,000 of its shares with a market value of $40 per share in exchange for all of Salisbury's shares, and Salisbury was dissolved.Palisade paid $20,000 to register and issue the new common shares.It cost Palisade $50,000 in direct combination costs.Book values equal market values except that Salisbury's land is worth $250,000.

On January 1, 2011 Palisade issued 30,000 of its shares with a market value of $40 per share in exchange for all of Salisbury's shares, and Salisbury was dissolved.Palisade paid $20,000 to register and issue the new common shares.It cost Palisade $50,000 in direct combination costs.Book values equal market values except that Salisbury's land is worth $250,000.

Required:

Prepare a Palisade balance sheet after the business combination on January 1, 2011.

Correct Answer:

Verified

The balance sheet for Palisade Corporati...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: According to FASB Statement 141R,which one of

Q9: Use the following information to answer

Q12: Samantha's Sporting Goods had net assets consisting

Q14: At December 31, 2011, Pandora Incorporated issued

Q14: Under the provisions of FASB Statement No.141R,in

Q15: Bigga Corporation purchased the net assets of

Q28: In a business combination,which of the following

Q30: A business merger differs from a business

Q34: Use the following information to answer

Q35: When considering an acquisition,which of the following