Multiple Choice

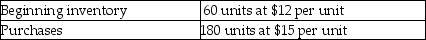

The following data was collected from the accounting records of Ambrose, Inc., for the month of June. 200 units were sold during the month. Ambrose currently uses the FIFO method of valuing inventory.  What would have been the difference in Ambrose's ending inventory under the LIFO costing method?

What would have been the difference in Ambrose's ending inventory under the LIFO costing method?

A) Ending inventory would have been $120 higher.

B) Ending inventory would have been $120 lower.

C) Ending inventory is the same under both methods.

D) The difference cannot be determined using this information.

Correct Answer:

Verified

Correct Answer:

Verified

Q31: A purchase allowance increases the cost of

Q32: The units of inventory available for sale

Q33: The gross profit rate is calculated as:<br>A)

Q34: Happy House Corporation reported net income of

Q35: If ending inventory for the year ended

Q37: The units of inventory available for sale

Q38: The disclosure principle requires that management prepare

Q39: If ending inventory is overstated by $6,000,

Q40: Under a perpetual inventory system, when a

Q41: Purr Company's ending inventory was $106,700 at