Multiple Choice

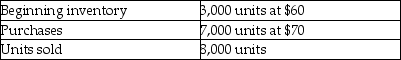

Given the following data, by how much would taxable income change if FIFO is used rather than LIFO?

A) Decrease by $20,000

B) Decrease by $19,000

C) Increase by $20,000

D) Increase by $19,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q19: The following transactions occurred for Melissa's Fine

Q20: Given the following data, what would the

Q21: The lower-of-cost-or-market rule is based on the

Q23: One way a company can deliberately overstate

Q25: The weighted-average cost per unit is calculated

Q26: Blue Moon Company has the following data

Q27: In the periodic inventory system, the inventory

Q28: The cost-of-goods-sold-model can help a company to

Q29: When inventory prices are falling, the LIFO

Q162: How do purchase returns and allowances and