Multiple Choice

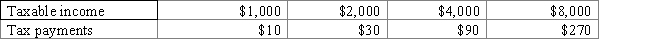

The following table shows tax payments made for various incomes.According to the information in the table below,the tax system is:

Table 3.1

A) progressive throughout all levels of income.

B) progressive between $1,000 and $2,000 of income but regressive above $2,000.

C) regressive throughout all levels of income.

D) regressive between $1,000 and $2,000 of income but progressive above $2,000.

E) proportional throughout all levels of income.

Correct Answer:

Verified

Correct Answer:

Verified

Q49: The Salvation Army is an example of

Q51: When the government sells something it produces,<br>A)revenue

Q55: To serve the public interest, government sometimes

Q56: Which of the following is not a

Q71: Which of the following is one of

Q98: Which of the following is a result

Q110: Which of the following is not based

Q145: Suppose you form a legal partnership with

Q146: The second largest source of tax revenue

Q168: A disadvantage of the corporate form of