Essay

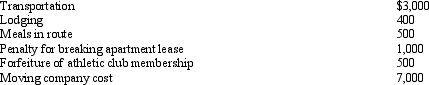

After graduating from college,Clint obtained employment in Omaha.In moving from his parents' home in Baltimore to Omaha,Clint incurred the following expenses:

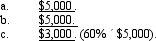

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q11: In terms of IRS attitude,what do the

Q24: In which, if any, of the following

Q31: If a taxpayer does not own a

Q34: Which of the following expenses, if any,

Q66: The § 222 deduction for tuition and

Q76: Lloyd, a practicing CPA, pays tuition to

Q78: In terms of meeting the distance test

Q98: Qualified moving expenses include the cost of

Q99: After she finishes working at her main

Q123: Nicole just retired as a partner in