Essay

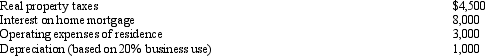

For the current year,Horton was employed as a deputy sheriff of a county.He had AGI of $50,000 and the following unreimbursed employee expenses:

How much of these expenses are allowed as deductions from AGI?

How much of these expenses are allowed as deductions from AGI?

Correct Answer:

Verified

$1,400.$1,000 + $1,000 + $400 = $2,400 -...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Dave is the regional manager for a

Q32: Elsie lives and works in Detroit. She

Q34: Jacob is a landscape architect who works

Q50: The work-related expenses of an independent contractor

Q54: Tired of renting, Dr.Smith buys the academic

Q106: Myra's classification of those who work for

Q113: Every year, Penguin Corporation gives each employee

Q116: Aiden is the city sales manager for

Q118: A taxpayer just changed jobs and incurred

Q122: Match the statements that relate to each