Essay

Regarding tax favored retirement plans for employees and self-employed persons,comment on the following:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

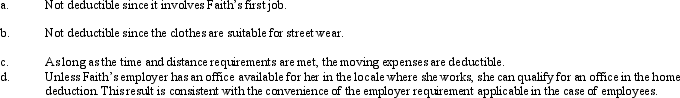

Q17: A taxpayer who maintains an office in

Q27: Qualified moving expenses of an employee that

Q37: Which, if any, of the following expenses

Q43: In contrasting the reporting procedures of employees

Q50: For tax purposes, a statutory employee is

Q72: Amy lives and works in St.Louis.In the

Q84: Dove Corporation pays for a trip to

Q100: The portion of the office in the

Q147: Concerning the deduction for moving expenses, what

Q151: In May 2012, after 11 months on