Multiple Choice

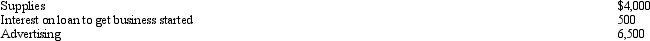

Priscella pursued a hobby of making bedspreads in her spare time.Her AGI before considering the hobby is $40,000.During the year she sold the bedspreads for $10,000.She incurred expenses as follows:  Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

A) Include $10,000 in income and deduct $11,000 for AGI.

B) Ignore both income and expenses since hobby losses are disallowed.

C) Include $10,000 in income, deduct nothing for AGI, and claim $10,000 of the expenses as itemized deductions.

D) Include $10,000 in income and deduct interest of $500 for AGI.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: During the year, Jim rented his vacation

Q28: Vera is the CEO of Brunettes, a

Q48: Payments by a cash basis taxpayer of

Q54: Ralph wants to give his daughter $1,000

Q80: For purposes of the § 267 loss

Q89: A salary that is classified as unreasonable

Q91: All employment related expenses are classified as

Q114: For a vacation home to be classified

Q132: Because Scott is three months delinquent on

Q143: Marvin spends the following amounts on a