Essay

Bridgett's son,Hubert,is $10,000 in arrears on his residential mortgage payments.Of the $10,000,$7,500 represents interest and $2,500 represents principal.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q36: The portion of property tax on a

Q50: Nikeya sells land (adjusted basis of $120,000)

Q53: In distinguishing whether an activity is a

Q59: For an expense to be deducted as

Q64: Trade of business expenses are classified as

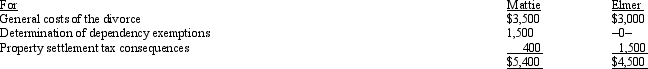

Q66: Mattie and Elmer are separated and are

Q77: Briefly explain the provisions regarding the deductibility

Q112: During the year,Martin rented his vacation home

Q133: None of the prepaid rent paid on

Q151: Beulah's personal residence has an adjusted basis