Essay

Walter sells land with an adjusted basis of $175,000 and a fair market value of $160,000 to his mother,Shirley,for $160,000.Walter reinvests the proceeds in the stock market.Shirley holds the land for one year and a day and sells it in the marketplace for $169,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Tom operates an illegal drug-running operation and

Q7: Velma and Josh divorced.Velma's attorney fee of

Q8: If part of a shareholder/employee's salary is

Q17: Are there any circumstances under which lobbying

Q22: Investigation of a business unrelated to one's

Q25: Under what circumstance can a bribe be

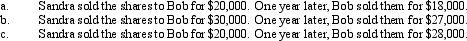

Q93: In a related-party transaction where realized loss

Q106: Can a trade or business expense be

Q140: Taylor, a cash basis architect, rents the

Q153: The expenses incurred to investigate the expansion