Multiple Choice

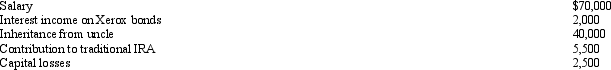

During 2012,Esther had the following transactions:  Esther's AGI is:

Esther's AGI is:

A) $62,000.

B) $64,000.

C) $67,000.

D) $102,000.

E) $104,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q13: In which, if any, of the following

Q43: Katelyn is divorced and maintains a household

Q63: Since an abandoned spouse is treated as

Q99: Which of the following taxpayers may file

Q122: Adjusted gross income (AGI) sets the ceiling

Q133: Ellen, age 12, lives in the same

Q142: After Carolyn moves out of the apartment

Q145: In applying the gross income test in

Q148: Monique is a resident of the U.S.and

Q148: A taxpayer who itemizes must use Form