Multiple Choice

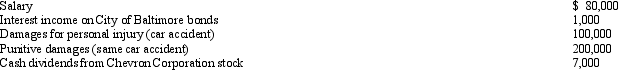

During 2012,Leona had the following transactions:  Leona's AGI is:

Leona's AGI is:

A) $185,000.

B) $187,000.

C) $285,000.

D) $287,000.

E) $385,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q9: When the kiddie tax applies and the

Q16: In terms of income tax consequences, abandoned

Q19: DeWayne is a U.S. citizen and resident.

Q39: A child who is married can be

Q55: Deductions for AGI are often referred to

Q56: Millie,age 80,is supported during the current year

Q63: Perry is in the 33% tax bracket.During

Q89: Under the Federal income tax formula for

Q96: In satisfying the support test and the

Q109: For tax purposes, married persons filing separate