Multiple Choice

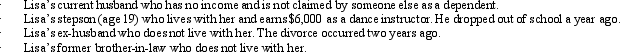

During 2012,Jen (age 66) furnished more than 50% of the support of the following persons:  Presuming all other dependency tests are met,on a separate return how many personal and dependency exemptions may Jen claim?

Presuming all other dependency tests are met,on a separate return how many personal and dependency exemptions may Jen claim?

A) Two.

B) Three.

C) Four.

D) Five.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: For the qualifying relative category (for dependency

Q24: In terms of the tax formula applicable

Q51: When can a taxpayer not use Form

Q80: Warren,age 17,is claimed as a dependent by

Q83: Match the statements that relate to each

Q88: Regarding head of household filing status,comment on

Q89: For 2012,Jackson has taxable income of $30,005.When

Q105: Lena is 66 years of age, single,

Q122: All exclusions from gross income are reported

Q146: Merle is a widow, age 80 and