Multiple Choice

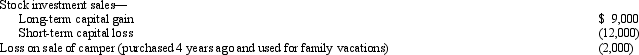

For the current year,David has salary income of $80,000 and the following property transactions:  What is David's AGI for the current year?

What is David's AGI for the current year?

A) $76,000.

B) $77,000.

C) $78,000.

D) $89,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q19: DeWayne is a U.S. citizen and resident.

Q58: When married persons file a joint return,

Q67: Heloise, age 74 and a widow, is

Q101: In resolving qualified child status for dependency

Q104: Clara, age 68, claims head of household

Q108: In determining the filing requirement based on

Q109: For tax purposes, married persons filing separate

Q118: Nelda is married to Chad, who abandoned

Q123: Benjamin, age 16, is claimed as a

Q138: In terms of timing as to any