Essay

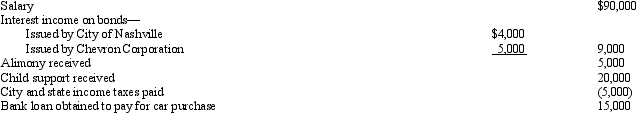

Ethan had the following transactions during 2012:

What is Ethan's AGI for 2012?

What is Ethan's AGI for 2012?

Correct Answer:

Verified

$90,000.$90,000 (salary)+ $5,000 (intere...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$90,000.$90,000 (salary)+ $5,000 (intere...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q15: Jason and Peg are married and file

Q28: Under what circumstances, if any, may an

Q33: A qualifying child cannot include:<br>A)A nonresident alien.<br>B)A

Q65: Claude's deductions from AGI slightly exceed the

Q79: In 2012, Warren sold his personal use

Q81: As opposed to itemizing deductions from AGI,

Q93: Roy and Linda were divorced in 2011.The

Q103: The Dargers have itemized deductions that exceed

Q117: List at least three exceptions to the

Q157: In order to claim a dependency exemption