Essay

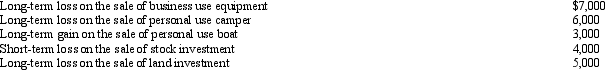

During the year,Irv had the following transactions:

How are these transactions handled for income tax purposes?

How are these transactions handled for income tax purposes?

Correct Answer:

Verified

Ordinary loss of $7,000 on the business ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Ordinary loss of $7,000 on the business ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q6: In which, if any, of the following

Q7: Kyle, whose wife died in December 2009,

Q26: Mr. Lee is a citizen and resident

Q26: Katrina, age 16, is claimed as a

Q27: Kirby is in the 15% tax bracket

Q44: In determining whether the support test is

Q46: Emily, whose husband died in December 2011,

Q128: Once a child reaches age 19, the

Q132: For the past few years, Corey's filing

Q140: Arnold is married to Sybil, who abandoned