Multiple Choice

Debby is a self-employed accountant with a qualified defined benefit plan (a Keogh plan) .She has the following income items for the year: What is the maximum amount Debby can deduct as a contribution to her retirement plan in 2012,assuming the self-employment tax rate is 15.3%?

What is the maximum amount Debby can deduct as a contribution to her retirement plan in 2012,assuming the self-employment tax rate is 15.3%?

A) $9,235.

B) $12,000.

C) $50,000.

D) $55,761.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: A participant who is at least age

Q62: If a person has funds from sources

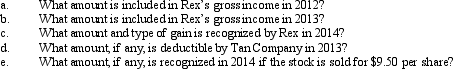

Q67: Pony,Inc.,issues restricted stock to employees in July

Q68: Yvonne exercises incentive stock options (ISOs)for 100

Q70: Pony,Inc.,issues restricted stock to employees in July

Q73: Higher compensation does not necessarily guarantee commensurate

Q74: The five-year cliff vesting alternative minimizes administrative

Q76: Dianna participates in a defined benefit plan

Q77: Income is not taxed if a taxpayer's

Q80: Low- and middle-income taxpayers may make nondeductible