Essay

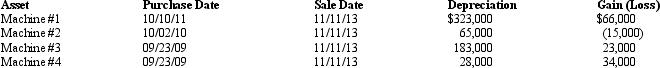

A business taxpayer sold all the depreciable assets of the business,calculated the gains and losses,and would like to know the final character of those gains and losses.The taxpayer had $353,000 of adjusted gross income before considering the gains and losses from sale of the business assets.The taxpayer had unrecaptured § 1231 lookback loss of $12,000.What is the treatment of the gains and losses summarized in the chart below after all possible netting and reclassification has been completed? What is the taxpayer's adjusted gross income? (Ignore the self-employment tax deduction.)

Correct Answer:

Verified

The taxpayer has adjusted gross income o...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Spencer has an investment in two parcels

Q2: An individual has the following recognized gains

Q7: The following assets in Jack's business were

Q20: If there is a net § 1231

Q47: Casualty gains and losses from nonpersonal use

Q55: Section 1245 depreciation recapture potential does not

Q59: Why is it generally better to have

Q67: The § 1245 depreciation recapture potential does

Q79: Jamison owned a rental building (but not

Q125: A barn held more than one year