Essay

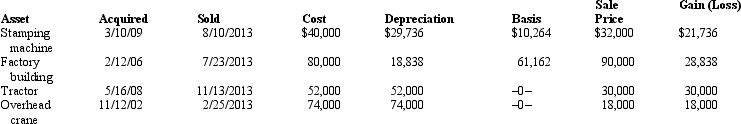

The chart below describes the § 1231 assets sold by the Tan Company (a sole proprietorship)this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year.Assume there is a § 1231 lookback loss of $14,000.

Correct Answer:

Verified

The stamping machine is sold at a $8,264...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: An individual taxpayer has the gains and

Q7: In the "General Procedure for § 1231

Q7: The following assets in Jack's business were

Q13: If § 1231 asset casualty gains and

Q20: If there is a net § 1231

Q29: Section 1245 may apply to depreciable farm

Q47: Casualty gains and losses from nonpersonal use

Q55: Section 1245 depreciation recapture potential does not

Q59: Why is it generally better to have

Q62: A retail building used in the business