Essay

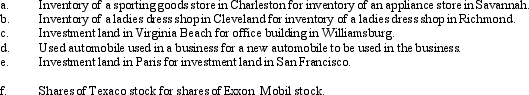

For the following exchanges,indicate which qualify as like-kind property.

Correct Answer:

Verified

Only items c.(investment realty for inve...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Only items c.(investment realty for inve...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q2: Jared, a fiscal year taxpayer with a

Q80: If boot is received in a §

Q88: Nancy and Tonya exchanged assets. Nancy gave

Q91: Melvin receives stock as a gift from

Q129: Discuss the treatment of realized gains from

Q146: Distinguish between a direct involuntary conversion and

Q188: The nonrecognition treatment on realized gains of

Q192: If boot is received in a §

Q197: What kinds of property do not qualify

Q208: Discuss the logic for mandatory deferral of